April 2025 Commercial Truck Guidelines

APRIL 2025 COMMERCIAL VEHICLE MARKET UPDATE

SUMMARY

Sales volume at auctions and on dealer lots increased impressively in March 2025. Encouragingly, pricing was stable to upward.

CLASS 8 AUCTION UPDATE

Auction volume increased notably in March, following the typical seasonal pattern. Pricing generally increased mildly as the market fully opened.

Looking at late-model sleeper tractors, average pricing for our benchmark truck in March was:

- Model year 2023: $80,263; $1,437 (1.8%) lower than February

- Model year 2022: $59,610; $1,522 (2.6%) higher than February

- Model year 2021: $46,588; $8,248 (21.5%) higher than February

- Model year 2020: $34,489; $2,642 (7.1%) lower than February

- Model year 2019: $28,498; $3,826 (15.5%) higher than February

At auctions in March, selling prices for the four- to-six-year-old cohort of our benchmark truck averaged 5.3% more than February, and 29.3% higher than March 2024. Pricing for that group is currently 17.9% higher than the strong pre-pandemic period of 2018 in nominal figures (7.0% lower if adjusted for inflation), and 88.6% higher than the last market nadir in late 2019 (51.9% higher when adjusted for inflation).

Five-year-old trucks in our focus group fared notably better this month, following two months of unusually low selling prices due to an unfavorable mix of specs and mileage for which our adjustments could not fully correct. Thanks to this recovery, our monthly depreciation average is flat for the year to date.

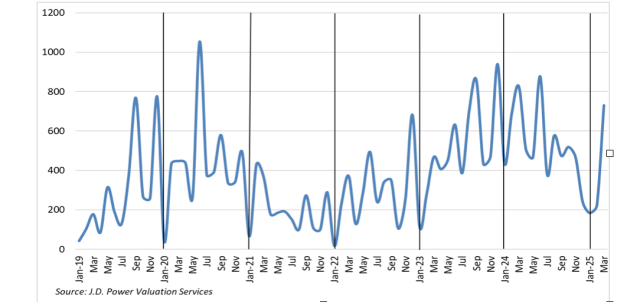

Volume of the Three Most Common Sleeper Tractors (3- to 7-Year-Old) Sold Through the Two Largest Nationwide No-Reserve Auctions