Year-Over-Year Auction Pricing Remains Positive

February is historically the second-lowest month of the year in terms of sales volume. February 2025’s volume was in line with this expectation, and pricing showed mild to moderate depreciation compared to January.

Looking at late-model sleeper tractors, average pricing for our benchmark truck in February was:

Model year 2023: $81,700; $1,951 (2.3%) lower than January

Model year 2022: $58,088; $301 (0.5%) lower than January

Model year 2021: $38,340; $2,665 (6.5%) lower than January

Model year 2020: $37,131; $2,641 (6.6%) lower than January

Model year 2019: $24,672; $160 (0.7%) higher than January

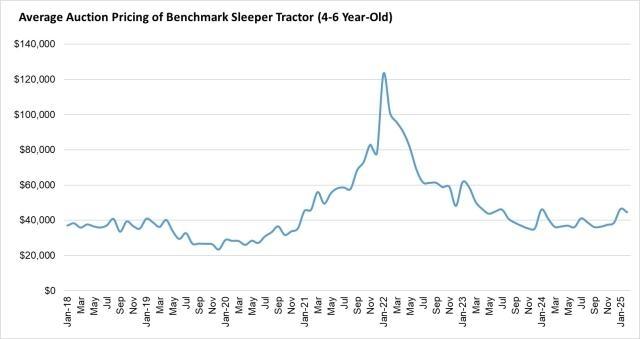

At auctions in February, selling prices for the four-to-six-year-old cohort of our benchmark truck averaged 4.0% less than January, but 8.9% higher than February 2024. Pricing for that group is currently 11.9% higher than the strong pre-pandemic period of 2018 in nominal figures (2.5% lower if adjusted for inflation), and 79.1% higher than the last market nadir in late 2019 (44.2% higher if adjusted for inflation). Trucks four and five years of age took a hit for the second month in a row.

Despite February’s depreciation, the year-over-year pricing comparison remains positive, continuing a trend that started in November 2024. Chaotic trade and tariff policy has shaken up freight forecasts, but at present, dynamics support a gradual tightening of capacity and improving truck utilization.