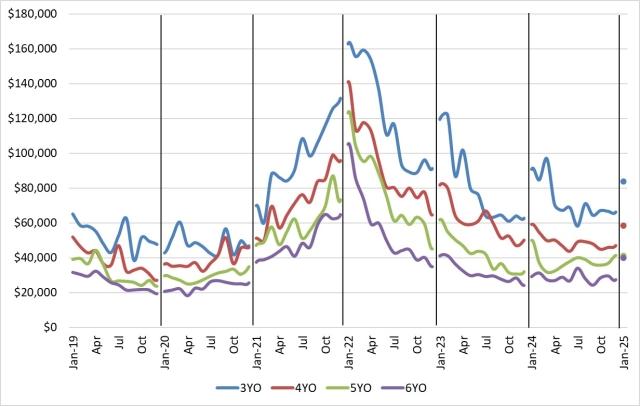

2025 Class 8 Auctions off to a Slow Start

With very few auctions on the calendar in the first half of the month, January is typically the slowest month of the year. January 2025 was no exception. This low volume of sales skewed the averages in our table lower than actual market movement. No mileage correction could have compensated for the huge swings in value in this month’s data. For detail and clarity on what actually happened in January, please see our subscription valuation products, available here and here.

Looking at late-model sleeper tractors, average pricing for our benchmark truck in January was:

Model year 2023: $83,651; $2,599 (3.0%) lower than December

Model year 2022: $58,389; $7,924 (11.9%) lower than December

Model year 2021: $41,005; $5,993 (12.8%) lower than December

Model year 2020: $39,772; $1,619 (3.9%) lower than December

Model year 2019: $24,512; $2,738 (10.0%) lower than December

Note as of this month, we are considering “four-to-six-year-old” to include model years 2022-2020. With that in mind, selling prices for that group in January 2025 were nearly identical to January 2024, with less than 1% separating the two periods. Pricing for that cohort is currently 16.6% higher than the strong pre-pandemic period of 2018 in nominal figures (7.0% lower if adjusted for inflation), and 75.3% higher than the last market nadir in late 2019 (42.7% higher if adjusted for inflation). Month-over-month comparisons will return next month.