Used Market Update: April 16, 2021

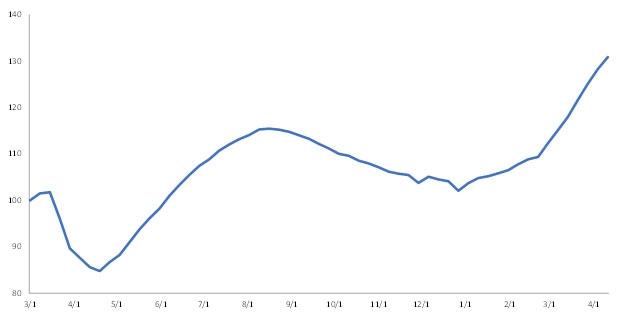

After increasing 2.5% for the week ending April 4, wholesale auction prices increased 2% during the week ending April 11. The week’s exceptional performance extends the streak of week-over-week price increases in the wholesale marketplace to 15 weeks. Wholesale prices are now 13.3% greater than their previous peak back in August 2020, and a massive 26.2% above their level at the end of December 2020.

Weekly Wholesale Auction Price Index (Mar 1 = 100)

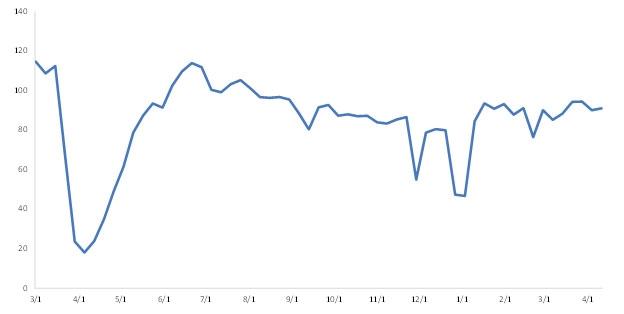

Wholesale Auction Sales Hold Steady ~90k Units

Wholesale auction sales of vehicles up to 8 years old reached approximately 91,000 units during the week ending April 11. Last week’s result was better than the previous week’s 90,000-unit figure, but slightly lower than the previous two periods combined average of 94,000 units. While week-over-week sales are relatively consistent, sales continue to run approximately 20% to 30% below prior year’s levels and last week’s result continues to emphasize how lean the wholesale marketplace is running, which is helping keep used prices strong.

Weekly Wholesale Auction Sales (000s)

In 2021, used prices are expected to remain near historic levels as pandemic-related macro-economic headwinds remain in place. By year's end, prices in Q4 2021 are expected to be up as much as 6% vs. Q4 2020 and will remain higher than pre-virus levels. It is important to note, however, that while the outlook remains optimistic, there remains a great deal of uncertainty surrounding the effect of vaccine roll out, federal stimulus, employment conditions, new vehicle production constraints, as well as the ongoing semiconductor (microchip) and other supply chain issues on the new side of the market. Given these unknowns, a heightened degree of used market volatility should be expected.