Used Market Update: December 4, 2020

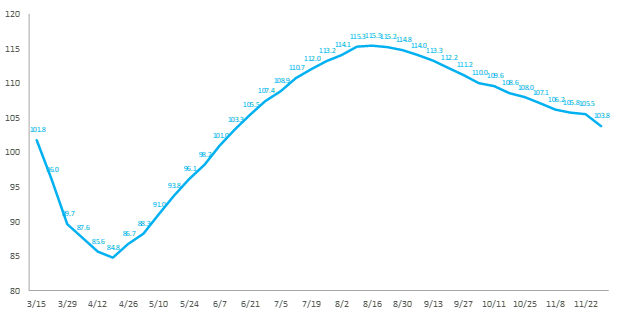

Wholesale auction prices down for 15th consecutive week. After several weeks of price declines, wholesale auction prices moved lower once again the week ending November 29 marking the 15th consecutive week of downward price movement. Prices last week were reduced by an average of 1.6% and have declined by 10% since their peak in August. While last week’s result was the softest performance since wholesale prices started to move lower, it should be noted that the market did pause in observance of the Thanksgiving holiday, which certainly dampened not only prices but also sales activity. Looking back, last year prices moved 1% lower during the same period. As wholesale prices continue moving lower, they remain 22% higher than their trough in April, and 4% above their level at the beginning of March.

Weekly Wholesale Auction Price Index (Mar 1 = 100)

Wholesale prices for mainstream segments declined by an average of 1.6% the week ending November 29 when compared to the prior week. Prices on the mainstream side were down across the board, however, results were mixed. For example, Midsize Pickup prices remained robust down a slight 0.5% while on the opposite end of the spectrum Midsize Van prices fell by nearly 5% for the week. Remaining mainstream segment prices fell between a range of approximately 1% (Small SUV) to 3% (Compact Car). Premium prices performed slightly better than their mainstream counterparts. On average, premium segment prices fell by 1.3% for the week ending November 15. Premium results were also much tighter than mainstream. Large Premium Car performed the best, down nearly 1%, while on the opposite end Midsize Premium Car prices fell by 2%.

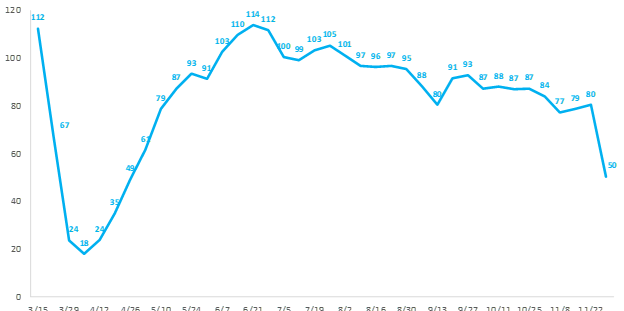

Wholesale Auction Sales Reach 50k Units

Wholesale auction sales of vehicles up to 8 years old for the week ending November 29 fell when compared to the prior week reaching approximately 50,000 units. After several weeks of steady sales volume in the 80,000 unit range, last week’s result was dampened by the Thanksgiving holiday and subsequent shutdowns. Looking back, over the past five years results for this same holiday period averaged a similar 55,000 units, in line with this year’s result.

Despite a slowing used market, wholesale prices remain strong. Prices are expected to continue to move lower through the end of December as pandemic-related macro-economic headwinds increase. By year's end, prices are still expected to be significantly greater than pre-virus levels. It is important to note, however, that while the outlook is relatively optimistic, there remains a great deal of uncertainty surrounding the impact of new virus outbreaks, the potential for another round of federal stimulus and overall employment conditions. Given these unknowns, a heightened degree of market volatility should be expected.