Lease Portfolio Expectations

The massive decline in wholesale auction prices has prompted many in the industry to speculate on the extent of captive finance company lease portfolio losses.

We will help address this question by first putting the size of current lease portfolios into perspective before providing our expectations for lease portfolio losses moving forward.

We will do this by leveraging J.D. Power’s Market Timer data, which provides projections for the number of vehicle owners and lessees who will return to market over the next 36 months, our full suite of wholesale price data (i.e., not just physical auction sales), and our current outlook for used vehicle wholesale prices.

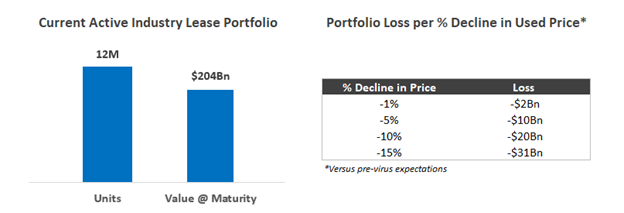

Starting with the current size of the lease market, we estimate that industry-wide there are currently 12 million active leases representing a combined value at maturity in excess of $200Bn. We estimate that industry-wide portfolio losses would reach $10Bn if used vehicle wholesale prices at lease maturity were 5% lower than expected, and $31Bn if prices were 15% lower than expected.

Big numbers to be sure. However, the roughly 12 million vehicles currently held in lease portfolios will not all reach maturity at the same time and, as such, portfolio losses must be viewed with this information in mind. For example, most new vehicle leases originated in 2017 will return to the market this year, three years after their origination. But why, you may ask, are we assuming most leases will terminate three years after origination? The reason for this assumption is that 36 months is by far the dominant term used in leasing. As such, as we look further out from today, most new vehicle leases originated in 2018 and 2019 and will mature in 2021 and 2022, respectively.

Given that we expect used wholesale prices to slowly recover from their depressed levels as the year progresses—as stay at home orders are relaxed and the economy improves—the real virus-related risk to lease portfolios is associated with near-term lease maturities rather than leases that will mature in 2021 and beyond.

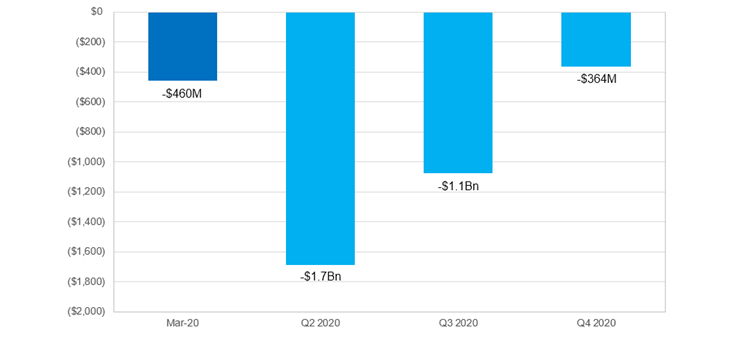

Specifically, we expect that industry-wide lease portfolio losses for maturing leases reached $460M in March 2020 due to the decline in wholesale prices versus pre-virus levels. Moving forward, we expect that softer than anticipated wholesale prices will lead to industry-wide losses approaching $1.7Bn in Q2 with the lesser amounts of $1.1Bn and $364M representing expected losses in Q3 and Q4, respectively, as used prices recover . Lease portfolio losses for maturing leases are expected to reach around $3.6Bn on a full year basis in 2020.

Industry-wide Lease Portfolio Loss Expectations

Looking further ahead, an anticipated recovery in used vehicle demand as economic conditions improve, coupled with a significant reduction in used vehicle supply, should support lease portfolios in 2021 and beyond. Regarding used supply, the pandemic has severely disrupted new vehicle sales and the inflow of rental, lease, and trade-in volume. As such, supply outflow over the coming months and years will also be impacted. The used market will see off-rental and off-lease supply rise above pre-virus expectations through June 2020, but increases will be tempered by a decline in consumer trade-ins. The increase in volume expected over the next two months is due in part to rental companies reducing their fleet sizes to better align to consumer demand. In a similar manner, rental companies are significantly reducing their new vehicle orders. This, along with the roughly 2 million to 4 million new vehicle sales that will not occur in 2020 due to the pandemic, will reduce used supply in 2021 and beyond thereby providing support to residual values, used prices and lease portfolios.

In a nutshell the takeaway is this—lease portfolios will experience substantial losses near-term, but the long-term outlook is significantly better.