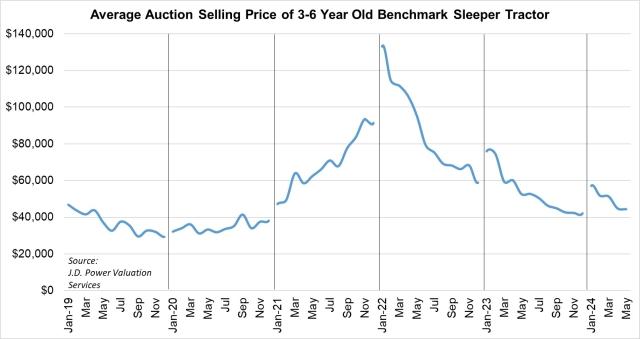

Class 8 Auction Pricing Largely Unchanged for Another Month

Auction volume of Class 8 sleeper tractors in May was very similar to April, which is historically typical. On a mileage-adjusted basis, pricing for these trucks was little changed. The market was more evenly weighted between low, average, and high-mileage trucks than any other month this year.

Looking at late-model sleeper tractors, average pricing for our benchmark truck in May was:

- Model year 2021: $46,797; $3,376 (6.7%) lower than April

- Model year 2020: $35,246; $2,813 (8.7%) higher than April

- Model year 2019: $28,698; $1,949 (7.3%) higher than April

- Model year 2018: $29,083; $9,782 (50.7%) higher than April

The unusual jump in average price of model-year 2018 trucks was due mainly to a more favorable mix of specs in the dataset, which is unusual to see month-over-month and therefore not a parameter we adjust for. Otherwise, in May, selling prices for four- to six-year-old sleepers were essentially unchanged for a 3rd month in a row, bringing 1.3% more money on average than April, and 1.8% more than March. Values for this age group are still about 7% lower than the strong pre-pandemic period of 2018 in nominal figures, or about 23% lower if adjusted for inflation. Current pricing is about 43% higher than the last market nadir in late 2019, or about 18% higher if adjusted for inflation. Depreciation in 2024 is averaging 4.3% per month. Pricing is now roughly halfway between 2018 (strong) and 2019 (weak) levels in real numbers.

Capacity utilization still points to an oversupplied market. Spot and contract freight rates remain below 2019 in real numbers, although spot appears to have stabilized. May’s results, like April’s, are somewhat stronger than expected. For now, buyers seem content with pricing in the current supply/demand environment.