Class 8 Auction Market Performed Better than Expected in April

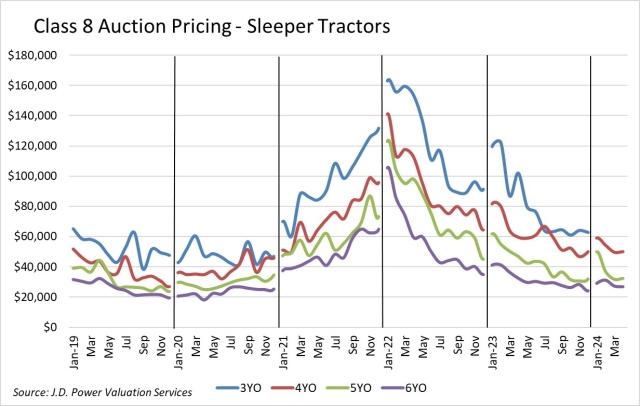

Auction volume of Class 8 sleeper tractors pulled back in April, which is typical for the month. On a mileage-adjusted basis, pricing for these trucks was little changed from March. However, anyone watching the large number of trucks with very high mileage for their age run through the lanes would be excused for feeling like trucks were bringing less money.

Looking at late-model sleeper tractors, average pricing for our benchmark truck in April was:

- Model year 2021: $50,173; $357 (0.7%) higher than March

- Model year 2020: $32,433; $640 (2.0%) higher than March

- Model year 2019: $26,749; $457 (1.7%) lower than March

- Model year 2018: $19,301; $2,197 (10.2%) lower than March

We have eliminated the 2022 model year from this table due to very low volume of trucks sold, which resulted in wild swings in the averages that were not market-reflective. We will add this model year back in when volume increases and we can draw a valid sample. Otherwise, in April, four- to six-year-old sleepers brought essentially equal money to March, and 21.4% less money than in April 2023. Values for this age group are now about 7% lower than the strong pre-pandemic period of 2018 in nominal figures, or about 23% lower if adjusted for inflation. Current pricing is about 43% higher than the last market nadir in late 2019, or about 18% higher if adjusted for inflation. Depreciation in 2024 is averaging 5.6% per month.

Pricing is now roughly halfway between 2018 (strong) and 2019 (weak) levels in real numbers. This is roughly where capacity utilization estimates and freight rates would suggest pricing should level out. However, we also know inventories are heavy and fleet returns will continue throughout the year. At this point we consider April’s results a mild upside surprise.