Auction Pricing Turned Downward in February

The bankruptcy liquidation of Yellow Freight’s trucks and trailers is impacting market conditions, particularly for trailers and the single-axle daycabs that comprised the majority of Yellow’s trucks. The first major sale of Yellow’s equipment took place on March 5, and pricing was what you might expect for a large number of trucks and trailers released into the market in a short period of time. Prior to last week, it was unusual to see a noticeable number of late-model single-axle daycabs in the marketplace, and selling prices reflected this increased supply. We’ll provide more observations next month when the liquidation’s impact to other segments, if any, is better understood.

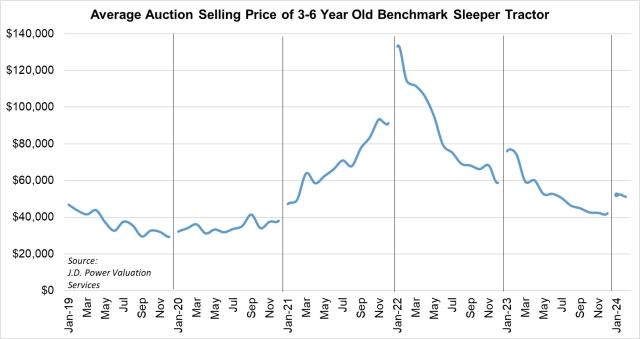

Shifting focus to the late-model sleeper segment, the number of those trucks sold at auction in February was comparable to January. In a change from the most recent 4-5 months, pricing dropped noticeably, particularly for the trucks that turned five years old in January. We’re watching March’s activity to see if volatility increased.

Looking at late-model sleeper tractors, average pricing for our benchmark truck in February was:

- Model year 2022: $82,500 (no basis for comparison with January)

- Model year 2021: $54,477; $4,698 (7.9%) lower than January

- Model year 2020: $37,064; $12,961 (25.9%) lower than January

- Model year 2019: $31,117; $2,097 (7.2%) higher than January

- Model year 2018: $24,791; $244 (1.0%) lower than January

The group above brought 11.3% less money than in January, and 30.4% less money than February 2023. Keeping in mind the model years in our age cohorts advanced by one year in January, values for the newest model years available in the marketplace are about 6% higher than the strong pre-pandemic period of 2018 in nominal figures, or about 13% less if adjusted for inflation. Current pricing is about 65% higher than the last market nadir in late 2019, or about 37% higher if adjusted for inflation. Stay tuned next week for our full monthly market update.